pasekadesign.ru

Overview

How To Invest To Index Funds

An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. Index funds purchase all the stocks in the same proportion as in a particular index. Check out the list of top performing index mutual funds and invest. An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or "index," like the popular S&P Index—as closely. Schwab Equity Index Funds are among the lowest-cost index funds around. Fund operating expenses are below the industry average, and there are no loads or. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. An index funds tracks the stock market as a whole. Instead of having a well-paid person on Wall Street choosing which stocks to buy, an index fund simply buys. Open a brokerage account with a financial firm and purchase an index fund. It should tell you the cost ratio (fees), which they take out of the. You can invest in index funds via a wide range of ETFs, REITs, ETCs and investment trusts if you have an account with us. Here are steps on how to buy index. Index investing, sometimes referred to as passive investing, is typically done by investing in a mutual fund or exchange-traded fund (ETF) that aims to. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. Index funds purchase all the stocks in the same proportion as in a particular index. Check out the list of top performing index mutual funds and invest. An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or "index," like the popular S&P Index—as closely. Schwab Equity Index Funds are among the lowest-cost index funds around. Fund operating expenses are below the industry average, and there are no loads or. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. An index funds tracks the stock market as a whole. Instead of having a well-paid person on Wall Street choosing which stocks to buy, an index fund simply buys. Open a brokerage account with a financial firm and purchase an index fund. It should tell you the cost ratio (fees), which they take out of the. You can invest in index funds via a wide range of ETFs, REITs, ETCs and investment trusts if you have an account with us. Here are steps on how to buy index. Index investing, sometimes referred to as passive investing, is typically done by investing in a mutual fund or exchange-traded fund (ETF) that aims to.

An index fund passively tracks the market. Index funds generally offer lower fees than their actively managed counterparts and solid returns. In this guide, we will dive deep into the world of index funds, exploring their advantages, how to choose the right one, and strategies to maximize your. However, you can buy shares of many index funds for well under $ per share. If you invest with a robo-advisor, they'll even divvy up your cash and buy. 1Efficient access– There's an index, and an index fund, for almost every market exposure and investment strategy you can possibly need. More choice gives. When you put money in an index fund, that cash is then used to invest in all the companies that make up the particular index, which gives you a more diverse. Now, indexed ETFs have further expanded the popularity and flexibility of index investing. Vanguard, the world's largest index fund company, now has over $5. Open a brokerage account with a financial firm and purchase an index fund. It should tell you the cost ratio (fees), which they take out of the. Index funds are simple, low-cost ways to gain exposure to markets. While stocks, bonds, commodities and real estate have been around for centuries. Welcome to Canadian Couch Potato, a blog designed for Canadians who want to learn more about investing using index mutual funds and exchange-traded funds. Investors who want broad exposure to the U.S. stock market can simply buy an index fund that invests in all of the stocks of the S&P rather than buying. An index fund is a type of mutual fund or exchange-traded fund (ETF) that holds all (or a representative sample) of the securities in a specific index. That's why you may hear people refer to indexing as a "passive" investment strategy. Instead of hand-selecting which stocks or bonds the fund will hold, the. You can also purchase an S&P index fund through a brokerage account and hold it either in an individual retirement account or a taxable account. You'll find. An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the. Index investing is a passive investment method achieved by investing in an index fund. An index fund is a fund that seeks to generate returns from the broader. What are the advantages? These funds charge significantly lower fees to investors than active funds. The reason is simple: the asset manager does not need to. Index investing, sometimes referred to as passive investing, is typically done by investing in a mutual fund or exchange-traded fund (ETF) that aims to. Index funds are part of the broad range of investment products called mutual funds. Like cooks making a stew, mutual fund managers add shares of various stocks. An index fund will attempt to achieve its investment objective primarily by investing in the securities (stocks or bonds) of companies that are included in a. You can buy index funds from the issuer itself, through an online broker, or with a financial advisor. Table Of Contents.

More Games Like Chumba Casino

Pulsz Casino. Pulsz Casino checks a lot of boxes, it really is one of the top casinos like Chumba available right now. Like Chumba, it's a. Best US Casinos provides in-depth online casino reviews and game guides for US gamblers. We focus on bonuses, fast payouts, and game variety to identify the. Wow Vegas - One of the best casinos similar to Chumba Casino This is another fun-loving scoial casino that has been picking up plenty of converts in recent. Betway Casino: Pretty solid reputation, offers a variety of games like slots, blackjack, and roulette. They're known for their quick payouts. Moonspin - One of the newest sites like Chumba Casino Moonspin was only launched in but it has already surpassed many other casinos like Chumba Casino. You can play these games for free in demo mode, and we have recommended the best sites and apps for anyone interested in playing each game for real money. Real. Some reputable alternatives to Chumba Casino include pasekadesign.ru, High 5 Casino, and Pulsz. Each of these platforms offers a unique selection of games and bonuses. However, McLuck is suitable for slot enthusiasts. Its + game collection consists mainly of slots and jackpot games. Four live dealer games highlight the. Check McLuck; it's a well-established social casino with many players daily and a massive variety of games to pick from, adding hundreds more. Pulsz Casino. Pulsz Casino checks a lot of boxes, it really is one of the top casinos like Chumba available right now. Like Chumba, it's a. Best US Casinos provides in-depth online casino reviews and game guides for US gamblers. We focus on bonuses, fast payouts, and game variety to identify the. Wow Vegas - One of the best casinos similar to Chumba Casino This is another fun-loving scoial casino that has been picking up plenty of converts in recent. Betway Casino: Pretty solid reputation, offers a variety of games like slots, blackjack, and roulette. They're known for their quick payouts. Moonspin - One of the newest sites like Chumba Casino Moonspin was only launched in but it has already surpassed many other casinos like Chumba Casino. You can play these games for free in demo mode, and we have recommended the best sites and apps for anyone interested in playing each game for real money. Real. Some reputable alternatives to Chumba Casino include pasekadesign.ru, High 5 Casino, and Pulsz. Each of these platforms offers a unique selection of games and bonuses. However, McLuck is suitable for slot enthusiasts. Its + game collection consists mainly of slots and jackpot games. Four live dealer games highlight the. Check McLuck; it's a well-established social casino with many players daily and a massive variety of games to pick from, adding hundreds more.

At Bovada you can play many popular slot games, like A Night with Cleo or Golden Buffalo. To make it even more exciting for our players we keep adding new Slots. A Closer Look At Our Top-Rated Sweepstakes Casinos · 1. Fortune Coins · 2. Crown Coins Casino · 3. Luckyland Slots · 4. Sportzino Casino · 5. High 5 Casino · 6. The current best alternatives we've uncovered are pasekadesign.ru, FunzPoints, Zitobox, Luckyland, and Pulsz. In this guide, we'll take you through all of these Chumba. If you love Chumba Casino but want to try similar sites: Fortune Coins, WOW Vegas, or High 5 Casino. They all have similar slot games and offer free sweeps. Games. An excellent alternative for Chumba is WOW Vegas, which is well-known for having more than slot machines from some of the most prominent software. Some reputable alternatives to Chumba Casino include pasekadesign.ru, High 5 Casino, and Pulsz. Each of these platforms offers a unique selection of games and bonuses. Sites like Chumba · Sites like Fliff · Sites like Fortune Coins · Sites like Zillion Games. +. Number of Slots. Show More. Snatch Casino. 8. Welcome. LuckyLand is similar to Chumba due to payment options and daily bonus deals. Slots are similar, though Chumba provides a more extensive collection of games. pasekadesign.ru is the World's Biggest and Most Reliable Source of Online Casino Bonus Codes, Reviews & Games! Join a Huge Community of Real Gamblers! When it comes to games, McLuck has you covered with over + titles, not to mention a well-stocked new releases section featuring games like Return to the. There are several alternatives to Chumba Casino such as LuckyLand Slots, Funzpoints, and Global Poker, each possessing unique features that may appeal to. UPDATE!!! AUG 22ND!! MORE IN ATTACHED DOC!! like funrize, good games, when it hit it HITS!! Liking it a lot so far.. Identical to PULSZ. Experience the thrill of slots and win real prizes at Chumba Casino. Play + social casino games. Claim your Welcome Bonus today! Chumba Casino, LuckyLand Slots, Pulsz, McLuck, Sweeptastic, WOW Vegas, and High 5 are unavailable in More Like This. Real Money No Deposit Bonuses. More related guides for you · Blackjack · Roulette · Gambling Games. Gambling guides · Video Poker. Video poker. SuperSlots – Best Casino Site Like Chumba Our number one Chumba Casino alternative is SuperSlots, which has been on the scene since Although a. Engage in exciting, fast-paced bingo games against other players, enjoying the classic game with the added chance of winning real money, all for. The game selection at Wow Vegas is comparable to Chumba Casino. They both offer a generous selection of free online slot games. The biggest difference between. The makers of industry hits like Golden Goddess, Cats, Davinci Diamonds, White Orchid, Black Widow and many more. Some of the top slot games from High 5 Games. Our jackpot games mean more bonus features, more spins, more fun, and Chumba Casino logo. Virtual Gaming Worlds logo. Global Poker logo. TERMS OF.

Universal Life Policies Pros And Cons

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

The cons of variable universal life insurance include complexity, higher cash needs, long time horizons and market risks. Variable universal life insurance is. Unlike whole life insurance, which has fixed premiums and benefits, UL allows you to increase or decrease your premium payments and adjust your death benefit as. Advantages and Disadvantages of Universal Life Insurance · Risk of large payment requirements or policy lapse · Returns are not guaranteed · Some withdrawals are. Indexed Universal Life Insurance Pros and Cons · Initial costs can be lower than Whole Life · Premiums can vary widely without triggering tax liabilities · Cash. A group universal life policy is universal life insurance offered to a group that is less expensive than what is typically offered to an individual. Universal life policies, with their market-linked investment components, are subject to the ups and downs of the stock market. This can lead to significant. Term life insurance advantages and disadvantages ; Pros. Cons ; It's typically less expensive than a permanent policy. It can provide a large death benefit at. Universal life insurance is a type of permanent life insurance and carries a cash value, the premium is divided into a savings portion and an investment. Advantages of variable universal life insurance · A death benefit that won't decrease** as long as you continue to make your minimum premium payments on time. The cons of variable universal life insurance include complexity, higher cash needs, long time horizons and market risks. Variable universal life insurance is. Unlike whole life insurance, which has fixed premiums and benefits, UL allows you to increase or decrease your premium payments and adjust your death benefit as. Advantages and Disadvantages of Universal Life Insurance · Risk of large payment requirements or policy lapse · Returns are not guaranteed · Some withdrawals are. Indexed Universal Life Insurance Pros and Cons · Initial costs can be lower than Whole Life · Premiums can vary widely without triggering tax liabilities · Cash. A group universal life policy is universal life insurance offered to a group that is less expensive than what is typically offered to an individual. Universal life policies, with their market-linked investment components, are subject to the ups and downs of the stock market. This can lead to significant. Term life insurance advantages and disadvantages ; Pros. Cons ; It's typically less expensive than a permanent policy. It can provide a large death benefit at. Universal life insurance is a type of permanent life insurance and carries a cash value, the premium is divided into a savings portion and an investment. Advantages of variable universal life insurance · A death benefit that won't decrease** as long as you continue to make your minimum premium payments on time.

1. Flexibility: As mentioned above, GUL policies offer a high degree of flexibility and customization. Policyholders can choose the amount of coverage that they. Guaranteed Universal Life Insurance · Your cost of insurance will not change, even as you get older or if your health changes. · Your coverage isn't tied to an. The advantage of these policies is that the premiums never change during the contract period. The disadvantage is that premiums may be higher than what you. Grows tax-deferred and withdrawals from premiums (not gains) are tax-free. Cons. Takes time to accumulate cash value. Borrowing and withdrawing may decrease the. Pros and cons of whole life insurance at a glance ; Permanent protection that lasts your entire life. Significantly more expensive than term life ; Premiums never. Indexed Universal Life (IUL) Insurance Pros and Cons · Provide higher returns than other life insurance policies · Allows tax-free capital gains · IUL does not. Disadvantages of Universal Life · Interest Rate Risk: The cash value growth in a universal life policy is tied to prevailing interest rates. · Complexity. Guaranteed Universal Life Insurance · Your cost of insurance will not change, even as you get older or if your health changes. · Your coverage isn't tied to an. Variable life insurance (VLI) builds cash value that often meets or exceeds the death benefit amount by the time the policy matures. It is a permanent policy that will last your entire life, and features both a death benefit and cash value that can build up over time. Plus, if you ever withdraw some of the cash value, you will subtract that same amount from your death benefit amount. Disadvantages Of Universal Life Insurance. In addition, universal life cash value accounts are typically higher risk and higher reward than whole life policies. With whole life insurance policies. Cons · Risk of termination: The biggest risk of a GUL policy is missing a payment. · No or minimal cash value: The beauty of guaranteed universal life insurance. Cons · Risk of termination: The biggest risk of a GUL policy is missing a payment. · No or minimal cash value: The beauty of guaranteed universal life insurance. The 15 ways universal life insurance is used list includes providing financial security for a family and protecting key people in business, as well as more. Cons of Indexed Universal Life · Con: Index Growth Options Are Capped or Diluted · Con: IUL Complexity Requires Ongoing Understanding · Con: No Guarantees Inside. Universal life insurance tends to be more expensive than term life insurance, especially in the early years of the policy. Indexed Universal life insurance policies have their benefits and shortcomings like any other policy. The following are some of the IUL pros and cons we. Universal life insurance Canada pros and cons · Internal costs are not always guaranteed (Policy owners may pay more for the pure insurance aspect if the. Whole life insurance covers you not only for death benefits, but also comes with an additional feature, which is known as a cash value accumulation component.

Stock Lawsuit

Christian Attar engages in all types of civil litigation, including shareholder and partnership disputes, and stock fraud. The Group operates domestically and. Those state decisions which held that a shareholder acquiring stock after Where the class-action character of the lawsuit is based solely on the. Securities Class Action Lawsuits recently field by Robbins Geller Rudman & Dowd LLP. Uber IPO Class Action Lawsuit Investigation Our investment fraud attorneys are investigating allegations that investors may have overpaid if they bought stock. As ISS Securities Class Action Services has shared with clients, the quantity of newly filed securities class action litigation has grown each year since Under the terms of the proposed settlement, class members are entitled to new procedures relating to the crediting of time toward eligibility for employment. The report found that plaintiffs filed securities class action lawsuits in federal and state courts in , up slightly from filings in The. The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section LawInfo provides free class action lawsuit legal information. Do I Have To Own Stock In The Company To Benefit From A Class Action? Read on to find out. Christian Attar engages in all types of civil litigation, including shareholder and partnership disputes, and stock fraud. The Group operates domestically and. Those state decisions which held that a shareholder acquiring stock after Where the class-action character of the lawsuit is based solely on the. Securities Class Action Lawsuits recently field by Robbins Geller Rudman & Dowd LLP. Uber IPO Class Action Lawsuit Investigation Our investment fraud attorneys are investigating allegations that investors may have overpaid if they bought stock. As ISS Securities Class Action Services has shared with clients, the quantity of newly filed securities class action litigation has grown each year since Under the terms of the proposed settlement, class members are entitled to new procedures relating to the crediting of time toward eligibility for employment. The report found that plaintiffs filed securities class action lawsuits in federal and state courts in , up slightly from filings in The. The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section LawInfo provides free class action lawsuit legal information. Do I Have To Own Stock In The Company To Benefit From A Class Action? Read on to find out.

SECURITIES LITIGATION. Hagens Berman represents shareholders in securities and financial fraud cases and is one of the nation's leading firms in this area. stock declines. Check the Securities Class Action Clearinghouse to find out whether a private class action lawsuit relating to a given investment has been. A securities class action is a lawsuit brought on behalf of a group of investors who have suffered an economic loss in a particular stock or security as a. Securities Class Action Lawsuits recently field by Robbins Geller Rudman & Dowd LLP. Securities class actions must always be brought in federal court, where plaintiffs face federal securities laws and procedural rules that are decidedly. Securities class actions must always be brought in federal court, where plaintiffs face federal securities laws and procedural rules that are decidedly. When you buy or sell stocks, and other securities, your transactions go through a broker, like Vanguard Brokerage. Money to pay for your purchases is taken from. The list below provides links to litigation releases concerning civil actions brought by the Commission in federal court. Our securities and financial services attorneys to represent them in state and federal court litigation, FINRA arbitrations, CFPB proceedings and other matters. The world of class actions has evolved dramatically over the last five years, requiring institutional investors to evaluate their existing governance, controls. This article provides an overview of shareholder actions under Section 10(b) of the Securities Exchange Act of , including the elements of a claim. Primary tabs. A shareholder (stockholder) derivative suit is a lawsuit brought by a shareholder or group of shareholders on behalf of the corporation against. Securities Registration & Exemption FAQs · RICE FAQs. Welcome to the Securities Division of the Office of the Secretary of the Commonwealth. Corporate Finance. In January , a short squeeze of the stock of the American video game retailer GameStop and other securities took place, causing major financial. Proceeds from class action lawsuits are treated the same as any other lawsuit settlement. Settlements or court awards for injury and sickness are non-taxable so. Our team includes + years of securities class action expertise, comprised of members with distinguished careers as litigators, settlement program architects. Our team includes + years of securities class action expertise, comprised of members with distinguished careers as litigators, settlement program architects. Stock Information. Back to main. Investors & Media. Stock Quote & Chart · Analyst Settlement Information. Settlement Information. Delaware Chancery Court. SECURITIES LITIGATION. Hagens Berman represents shareholders in securities and financial fraud cases and is one of the nation's leading firms in this area. Legal news and analysis on securities. Covers lawsuits, enforcement, shareholders, derivatives, fraud, ERISA, accounting, insider trading, legislation.

Financial Literacy Skills

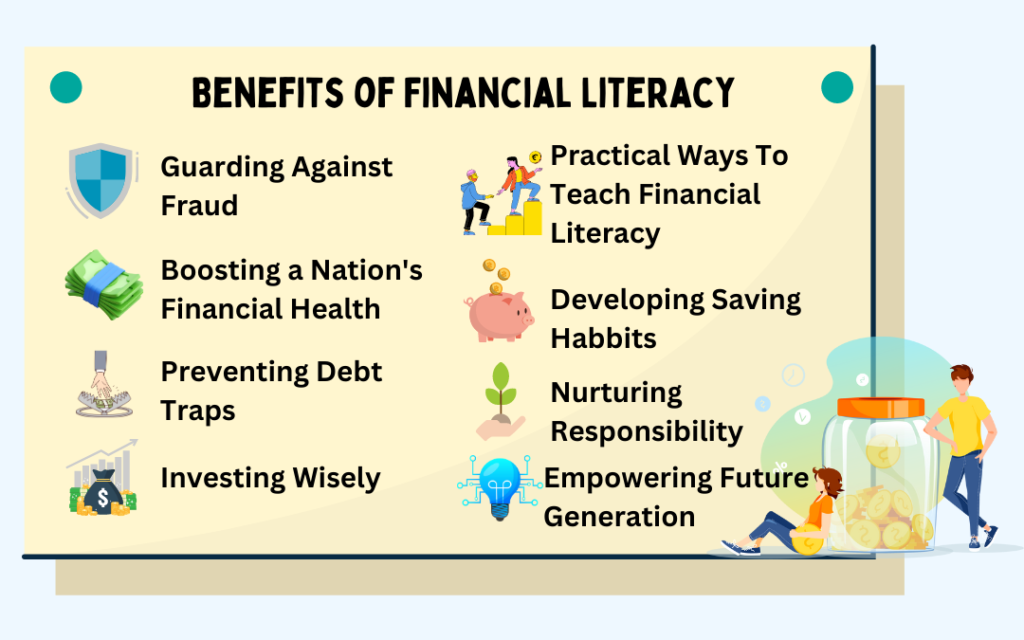

Financial literacy is a set of skills and knowledge that allows you to make informed decisions about managing your money and financial resources. Financial literacy means possessing the knowledge and skills needed to make informed decisions about financial matters. This includes learning how to manage. Six financial literacy principles · 1. Budget your money · 2. Taxation—it's not all yours · 3. Borrowing · 4. Plan before investing · 5. Invest to achieve your goals. Financial literacy are the knowledge and skills that are needed to make sound financial decisions. Learning the basics about consumption, budgeting, saving. Anyone who has had to make a budget or pay a bill knows that financial literacy is an important life skill, and yet so many high school students graduate. Financial literacy is the knowledge of an individual of financial matters like budgeting, investing, banking, and personal financial management, etc. This is. Learning how to earn, spend, save and invest wisely can help enhance overall well-being and stability. Improved personal finance management skills — Financially literate individuals have the skills to manage their finances effectively. It includes creating and. What is Financial Literacy? Financial literacy is having the knowledge, skills and confidence to make responsible financial decisions independently. Having. Financial literacy is a set of skills and knowledge that allows you to make informed decisions about managing your money and financial resources. Financial literacy means possessing the knowledge and skills needed to make informed decisions about financial matters. This includes learning how to manage. Six financial literacy principles · 1. Budget your money · 2. Taxation—it's not all yours · 3. Borrowing · 4. Plan before investing · 5. Invest to achieve your goals. Financial literacy are the knowledge and skills that are needed to make sound financial decisions. Learning the basics about consumption, budgeting, saving. Anyone who has had to make a budget or pay a bill knows that financial literacy is an important life skill, and yet so many high school students graduate. Financial literacy is the knowledge of an individual of financial matters like budgeting, investing, banking, and personal financial management, etc. This is. Learning how to earn, spend, save and invest wisely can help enhance overall well-being and stability. Improved personal finance management skills — Financially literate individuals have the skills to manage their finances effectively. It includes creating and. What is Financial Literacy? Financial literacy is having the knowledge, skills and confidence to make responsible financial decisions independently. Having.

1. What is Financial Literacy? · 2. Why Does Financial Literacy Matter for Students? · 3. How Can I Minimize the Long-Term Impact of Student Loans on My Financial. Equip communities with essential life skills: Discover interactive, online financial literacy classes designed for teachers, parents, and financial. General Financial Literacy Statistics · 25% of Americans say they don't have anyone they can ask for trusted financial guidance. · In , 28% of adults reported. The skills needed to effectively participate in your community. Understanding and accepting the traditions of a group of people. Being able to keep up with. Financial literacy skills means having the confidence, knowledge, and skills needed to make financial decisions that promote financial self-sufficiency. If you are financially literate, you often have less debt and more savings. You have also learned a skill that can be effective for budgeting and spending at. Developing comprehensive financial literacy policies and strategies. Financial literacy is a a set of awareness, knowledge, skills, attitudes, and behaviours. Being financially literate means having the knowledge and confidence to effectively manage, save and invest money for you and your family. Financial literacy is the possession of skills, knowledge, and behaviors that allow an individual to make informed decisions regarding money. Financial literacy is the possession of skills, knowledge, and behaviors that allow an individual to make informed decisions regarding money. Financial literacy is the cognitive understanding of financial components and skills such as budgeting, investing, borrowing, taxation, and personal financial. Key aspects of financial literacy are budgeting, saving and managing debt. Men using laptop computer and texting on mobile phone. These skills include how to earn and save money; manage money by being a wise consumer and creating and using a budget; manage bank accounts, investments, and. Each month, we honor an Innovative Educator who has found exciting new ways to teach financial skills. Why Financial Literacy In Schools Matters Today For the. What is Financial Literacy? Financial literacy is the combined knowledge and skills required to make responsible and informed financial decisions that. Money management, budgeting, risk awareness, and avoiding scams are a few examples of skills taught through financial literacy classes. Why Financial Literacy. 10 Tips for Financial Literacy Month · Create a budget: Start by calculating your monthly income and expenses. · Track your spending: Keep track of every dollar. Being financially literate means having general knowledge of the fiscal and economic landscape of business. These skills include how to earn and save money; manage money by being a wise consumer and creating and using a budget; manage bank accounts, investments, and. Financial literacy is a crucial body of knowledge and skills that empowers people to make informed decisions about their finances, plan for the future, and.

Should I Roll Over My 401k When I Retire

3. Do I have to roll over my (k) when I retire? You don't have to roll over your (k), but when you leave your money with your former employer's plan. What should one do with these retirement plans if your move across the border and The k must be a transferrable plan with a lump sum transfer in. Generally, there are no tax implications if you complete a direct rollover and the assets go directly from your employer-sponsored plan into a Rollover or. (k) Rollover Real Talk · If your (k) balance is modest (less than $5, for some plans), your former employer may remove you from their plan and send you. If you're no longer working for the employer that set up your (a) plan, you can roll it over to a different retirement account. Learn about rollover. If you have a k plan, you do not need to make RMDs from your current employer's k until you officially stop working for them. Thus, you can keep your. 4 options for an old (k): Keep it with your old employer's plan, roll over the money into an IRA, roll over into a new employer's plan (including plans. You can generally maintain your (k) with your former employer or roll it over into an individual retirement account. retirement, you could also move your. You can generally maintain your (k) with your former employer or roll it over into an individual retirement account. IRAs maintain the same tax benefits of a. 3. Do I have to roll over my (k) when I retire? You don't have to roll over your (k), but when you leave your money with your former employer's plan. What should one do with these retirement plans if your move across the border and The k must be a transferrable plan with a lump sum transfer in. Generally, there are no tax implications if you complete a direct rollover and the assets go directly from your employer-sponsored plan into a Rollover or. (k) Rollover Real Talk · If your (k) balance is modest (less than $5, for some plans), your former employer may remove you from their plan and send you. If you're no longer working for the employer that set up your (a) plan, you can roll it over to a different retirement account. Learn about rollover. If you have a k plan, you do not need to make RMDs from your current employer's k until you officially stop working for them. Thus, you can keep your. 4 options for an old (k): Keep it with your old employer's plan, roll over the money into an IRA, roll over into a new employer's plan (including plans. You can generally maintain your (k) with your former employer or roll it over into an individual retirement account. retirement, you could also move your. You can generally maintain your (k) with your former employer or roll it over into an individual retirement account. IRAs maintain the same tax benefits of a.

The day rollover rule is a less widely known “loophole” that enables retirement savers to tap their funds for short-term needs. The Negatives Of A Rollover. The primary benefit of an IRA rollover is having access to a wider range of investment options, since you'll be in control of your retirement savings rather. Leave your account with your former employer. If your plan sponsor allows it, you can keep your retirement savings in their plan after you leave. · Move the. When you leave a job with a (k), you should consider rolling over your retirement money into a new account. Check out some options. Generally it's best to rollover an old k to an IRA. However, one notable exception is if you currently or plan to make backdoor Roth IRA. Am I eligible to roll over an employer-sponsored retirement account to an IRA? Three of the options – leaving your money in the plan, moving it to your new employer's plan and rolling over to an IRA – will allow you to continue to earn. Early Retirement Benefits "One of the most important reasons not to roll over your (k) to an IRA is to have access to your funds before age 59½," says. When you leave an employer, you typically have four options for what do with your savings from a qualified employer sponsored retirement plan (QRP) such as a. Roll over your old (k) into an IRA as soon as possible. IRA fees are both more transparent and lower than (k) fees, you have a much wider range of. When you roll over a retirement plan distribution, you generally don't pay tax on it until you withdraw it from the new plan. By rolling over, you're saving for. Rolling over your (k) to an IRA (Individual Retirement Account) is one way to go, but you should consider your options before making a decision. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free. Can I roll over my employer-sponsored retirement plan assets into a Vanguard IRA? If you plan to convert Traditional savings to Roth IRA holdings, keeping funds in a (k) might simplify your life. Doing so could minimize the amount of pre-. These rollovers may help you more effectively manage your retirement savings and diversify your investments. It is important to really weigh the pros and cons. The check should be made payable to Fidelity Management Trust Company (or FMTC), FBO [your name] and does not need to be endorsed. Be sure to ask your former. Consolidating these retirement accounts makes it easier to track your progress against your savings goals and ensures you can manage your retirement investments. When you roll over a retirement plan distribution, you generally don't pay tax on it until you withdraw it from the new plan. By rolling over, you're saving for. The day rollover rule is a less widely known “loophole” that enables retirement savers to tap their funds for short-term needs. The Negatives Of A Rollover.

How To Buy A Crypto

Find step by step guide with video instructions on how to buy Bitcoin (BTC) on Binance. Our platform offers the lowest fees and highest security to buy and. Heres how to buy crypto, from researching a specific cryptocurrency or asset to finalizing a purchase. Buy crypto fast, easily and securely with BitPay. Pay with a credit card, debit card, Apple Pay or Google Pay. Enter your wallet address and use your crypto. How to buy crypto with MetaMask. Onboard to crypto with MetaMask. Just click on the “Buy” button on the MetaMask browser extension or mobile app to get started. Cryptocurrencies can be bought on traditional investment platforms, crypto exchanges, select mobile payment services, and alternative platforms. The pasekadesign.ru App supports over popular cryptocurrencies, and users can start buying them following a quick onboarding process. You can buy Bitcoin and crypto in Exodus with various payment methods, including debit card, credit card, bank account, PayPal, Apple Pay, or Google Pay. MoonPay offers a fast and simple way to buy and sell cryptocurrencies. Buy crypto with credit card, bank transfers of Apple Pay today. How do I use PayPal to buy and sell crypto through my external wallet? · Log in to your crypto wallet. · Tap Buy or Sell, then select 'PayPal.' · Enter the USD. Find step by step guide with video instructions on how to buy Bitcoin (BTC) on Binance. Our platform offers the lowest fees and highest security to buy and. Heres how to buy crypto, from researching a specific cryptocurrency or asset to finalizing a purchase. Buy crypto fast, easily and securely with BitPay. Pay with a credit card, debit card, Apple Pay or Google Pay. Enter your wallet address and use your crypto. How to buy crypto with MetaMask. Onboard to crypto with MetaMask. Just click on the “Buy” button on the MetaMask browser extension or mobile app to get started. Cryptocurrencies can be bought on traditional investment platforms, crypto exchanges, select mobile payment services, and alternative platforms. The pasekadesign.ru App supports over popular cryptocurrencies, and users can start buying them following a quick onboarding process. You can buy Bitcoin and crypto in Exodus with various payment methods, including debit card, credit card, bank account, PayPal, Apple Pay, or Google Pay. MoonPay offers a fast and simple way to buy and sell cryptocurrencies. Buy crypto with credit card, bank transfers of Apple Pay today. How do I use PayPal to buy and sell crypto through my external wallet? · Log in to your crypto wallet. · Tap Buy or Sell, then select 'PayPal.' · Enter the USD.

It's easy to buy crypto, just pick a crypto exchange, verify and fund your account and pick a crypto to buy. The vast majority of crypto exchanges now allow you. Buy Bitcoin and many other cryptocurrencies on KuCoin with a selection of over 70 payment methods, including credit and debit cards, bank transfers, fiat. cryptocurrencies and advanced crypto trading features This is not an offer, or solicitation of any offer to buy or sell any security, investment or other. If you want to purchase Bitcoin, then you look for a reliable crypto exchange. pasekadesign.ru is a secure and reputable platform that allows you to instantly buy. The World's Premier Crypto Trading Platform. Buy Bitcoin, Ethereum, and + cryptocurrencies. Trade with 20+ fiat currencies and Apple/Google Pay. Buy on pasekadesign.ru · Sign into Coinbase. · Select Buy / Sell · From the Buy tab, select the asset you'd like to purchase. · Enter the amount you'd like to buy. Compare rates and buy cryptocurrency instantly with debit card, credit card, bank transfer, or local methods from anywhere. Invest in Bitcoin with Invity. Coinbase is a secure online platform for buying, selling, transferring, and storing cryptocurrency. To purchase bitcoin, you will first need to create an account, the process of which will vary depending on your chosen exchange. Buy Bitcoin instantly with Gemini. Read our guide on how to buy Bitcoin on Gemini. Gemini is the trusted crypto-native finance platform to buy, sell, store. On Bisq, users can buy and sell Bitcoin and other types of crypto using various payment methods, including bank wire transfers, ACH transfers, and cash deposits. Buying bitcoin from the pasekadesign.ru website · Visit our Buy Bitcoin page. · Select Bitcoin (BTC). · Choose whether you want to pay in USD or another local. Cryptocurrency investing can take many forms, ranging from buying cryptocurrency directly to investing in crypto funds and companies. Frequently Asked Questions · 1. Log into your pasekadesign.ru account on the web or using the pasekadesign.ru Mobile App · 2. Click the Buy Crypto button on the web or. Ledger makes the first steps of your crypto journey easier and way more secure. The simple, safe, smart way to buy Bitcoin, Ethereum and more crypto. Buy and sell crypto quickly and securely with Ramp's seamless fiatcrypto experience. Retail investors looking to enter the market can now choose between buying crypto outright or buying a crypto-related asset. You can buy crypto on Kraken's crypto trading platform. Create your free account and connect a funding method to buy over cryptocurrencies. Kraken makes it. PayPal now supports cryptocurrency for Personal account holders, with options to buy, sell, hold and transfer digital currencies securely starting from $1. Schwab has several choices for gaining exposure to cryptocurrency markets, though spot trading of cryptocurrency is not currently available.

Green Bonds Explained

Climate bonds are fixed-income financial instruments (bonds) linked to climate Explaining green bonds · Stock Exchanges with Green Bond Segments · Data. A green bond is a debt instrument designed specifically to support specific climate-related or environmental projects. Investing in Green Bonds is a good choice. A green bond is a fixed income debt instrument in which an issuer (typically a corporation, government, or financial institution) borrows a large sum of money. Types of Green Bonds. Green bonds are defined as debt instruments used to finance projects that have positive environmental and/or climate impact. These. The first U.S. bank to issue a benchmark-sized corporate green bond · Co-authored the original version of the Green Bond Principles, a voluntary set of. Green, Social and Thematic Bonds are fixed-income financial instruments issued with the aim of addressing climate change and facilitating environmental and. A green bond is a debt security issued by an organization for the purpose of financing, or re-financing, projects that contribute positively. Green bonds play an important role in financing assets needed for the low-carbon transition. With the European Green Bond Standard, the EU is aiming to set. These bonds are devoted to financing new and existing projects or activities with positive environmental impacts. We believe impactful green bonds should be. Climate bonds are fixed-income financial instruments (bonds) linked to climate Explaining green bonds · Stock Exchanges with Green Bond Segments · Data. A green bond is a debt instrument designed specifically to support specific climate-related or environmental projects. Investing in Green Bonds is a good choice. A green bond is a fixed income debt instrument in which an issuer (typically a corporation, government, or financial institution) borrows a large sum of money. Types of Green Bonds. Green bonds are defined as debt instruments used to finance projects that have positive environmental and/or climate impact. These. The first U.S. bank to issue a benchmark-sized corporate green bond · Co-authored the original version of the Green Bond Principles, a voluntary set of. Green, Social and Thematic Bonds are fixed-income financial instruments issued with the aim of addressing climate change and facilitating environmental and. A green bond is a debt security issued by an organization for the purpose of financing, or re-financing, projects that contribute positively. Green bonds play an important role in financing assets needed for the low-carbon transition. With the European Green Bond Standard, the EU is aiming to set. These bonds are devoted to financing new and existing projects or activities with positive environmental impacts. We believe impactful green bonds should be.

A green bond is a type of investment that provides a fixed income and aims to raise capital for climate, sustainability and environmental projects. Green bonds, at their core, are a specialized form of investment that focuses on supporting environmentally friendly initiatives. The green bond proceeds. Green bonds first appeared in , when the European Investment Bank and the World Bank issued the first bond with an environmental focus. After a few years of. Types of Green Bonds. Green bonds are defined as debt instruments used to finance projects that have positive environmental and/or climate impact. These. Green bonds raise funds for new and existing projects which deliver environmental benefits, and a more sustainable economy. Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial. This could be explained by: – The nature of green bond issuers: historically large institutions with well-established governance structures, hence more. What is a sustainability bond? As defined by ICMA, sustainability bonds are bonds where the proceeds will be exclusively applied to finance. Green Bonds are bonds of which the proceeds will be allocated to green, or climate-related, expenditures and investments. for Issuing Green Bonds. 6. Page 7. Key Recommendations. Green Bond Frameworks. Issuers should explain the alignment of their Green Bond or Green. Bond. But by far the most commonly issued Green Bond is the Standard Green. Use of Proceeds Bond, defined by ICMA as 'a standard recourse to the issuer debt. Green bonds are bonds where the money from the bonds are earmarked for green CSRD explained: Supporting clients with their double materiality assessments. Green Bond Principles or the Climate Bonds Taxonomy. The former describes This predominance is partly explained by the facts that some of these sectors. defined by international guidelines such as those published by ICMA and CBI. (in)-credibly green: Which bonds trade at a green bond premium? The main difference is that the funds will be used only for positive climate change or environmental projects. This allows investors to target their. for Issuing Green Bonds. 6. Page 7. Key Recommendations. Green Bond Frameworks. Issuers should explain the alignment of their Green Bond or Green. Bond. Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial. green projects4 falling under 'Eligible Categories' defined in Table 1. 4 ICMA Green Bond Principles: Voluntary Process Guidelines for Issuing Green Bonds. The issuance of green bonds—tax-exempt bonds issued by federally qualified organizations and municipalities for the development of brownfield sites—has.

Meaning Of Stimulus Check

:max_bytes(150000):strip_icc()/Investopedia_StimulusCheck-70459e6dcc644ec28a518b746239f62f.jpg)

In economics, a stimulus is an injection of money into an economy by a government that's intended to spur (stimulate) economic growth. This can take many forms. You could not be signed in, please check and try again. In an animal specific receptors are sensitive to stimuli. From: stimulus in A Dictionary of Biology». A stimulus check is a payment authorized by the U.S. government to help cope with a period of economic difficulty. The most recent checks paid out to reduce the. Taber's Medical Dictionary Online website. pasekadesign.ru Check Symptoms & Get Care · Patient Representatives Offices · Language and. A stimulus check is money sent to a taxpayer by the U.S. government to stimulate the economy by providing consumers with some spending money. Definition of stimulus noun in Oxford Advanced Learner's Dictionary. Meaning Check pronunciation: stimulus. Nearby words. stimulating adjective · stimulation. Under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, eligible individuals and families will receive Economic Impact Payments (stimulus. The scaled back stimulus package does not include funding for a second round of $1, stimulus checks—a proposal that for months Republican and Democratic. These payments are technically an advance payment of a tax credit. The biggest differences between the third stimulus checks for expats and the other two. In economics, a stimulus is an injection of money into an economy by a government that's intended to spur (stimulate) economic growth. This can take many forms. You could not be signed in, please check and try again. In an animal specific receptors are sensitive to stimuli. From: stimulus in A Dictionary of Biology». A stimulus check is a payment authorized by the U.S. government to help cope with a period of economic difficulty. The most recent checks paid out to reduce the. Taber's Medical Dictionary Online website. pasekadesign.ru Check Symptoms & Get Care · Patient Representatives Offices · Language and. A stimulus check is money sent to a taxpayer by the U.S. government to stimulate the economy by providing consumers with some spending money. Definition of stimulus noun in Oxford Advanced Learner's Dictionary. Meaning Check pronunciation: stimulus. Nearby words. stimulating adjective · stimulation. Under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, eligible individuals and families will receive Economic Impact Payments (stimulus. The scaled back stimulus package does not include funding for a second round of $1, stimulus checks—a proposal that for months Republican and Democratic. These payments are technically an advance payment of a tax credit. The biggest differences between the third stimulus checks for expats and the other two.

A pathetic amount of money that has little to no use. I checked under the couch cushions for enough money to buy a popsicle but I only found a stimulus check. If you don't have a bank account registered with the IRS for direct deposits, you should receive a stimulus check in the mail. What Does Payment Status. Important information for Kansas with disabilities on the third economic impact payment (stimulus check) being distributed in Spring This might mean that. The stimulus check is the same as a tax credit, and it is specifically an advanced refundable tax credit, meaning it is a refund allotted to you and is also. A stimulus package is a package of economic measures put together by a government to stimulate a struggling economy. Economic Impact Payments –commonly referred to as “stimulus checks” or “recovery rebates”– are a key provision of the Coronavirus Aid Relief, and Economic. The compromise legislation sent to the White House to be signed into law will provide stimulus checks to most Americans including seniors living only on Social. Economic stimulus payment or economic impact payment may refer to several tax rebates, tax credits, tax deductions and grants from the federal government of. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) authorized Economic Impact Payments, commonly referred to as stimulus payments. Stimulus. Definition of stimulus noun in Oxford Advanced Learner's Dictionary. Meaning Check pronunciation: stimulus. Nearby words. stimulating adjective · stimulation. Stimulus package meaning A stimulus package is a set of economic actions and plans established by a government to help stabilize or reinvigorate the economy. State "stimulus" checks (also called inflation relief payments or in some cases, state tax rebates) have been a huge topic in the past year. If no issue record is in the Treasury Check Verification System (TCVS), it does not mean the check is invalid. Please note TCVS was created as a tool to. If the IRS did not have an individual's direct deposit information, the individual should have received payments via physical checks or Economic Impact Payment. President Biden proposed a $ trillion stimulus bill called the American Rescue Plan which includes a third round of Economic Impact Payments (also known as. Interest rates could fall soon and be a stimulus to the economy. American English: stimulus /ˈstɪmyələs/; Brazilian Portuguese: estímulo; Chinese. Hi Sanjeev Basra,thanks for the A2A. Definition: “Stimulus Check” is a US term that refers to payment given by the US government to the. A stimulus package is defined as a collection of economic actions taken by the state to boost a sinking economy. Stimulus Payment Trace · If the IRS determines that the check was not cashed, they will credit your account for the payment. This does not mean they are issuing. North Carolina families with qualifying children who were 16 or younger at the end of who did not already receive the $ check from the NC Department of.

Best Car Insurance Rates In Georgia

COUNTRY Financial offers the cheapest minimum car insurance policy in Georgia and for most driver profiles. Other types of drivers, like teens. Whether you're a standard driver or a high-risk driver, we compare rates to find you cheap car insurance for the coverage you need to drive safely on Georgia. Car insurance in Georgia costs $ for a 6-month policy — 18% more expensive than than the national average rate. Compare the cheapest car insurance quotes in Atlanta from Hugo, Auto-Owners, State Farm, and more. Quotes updated August We work with several car insurance companies in Georgia to provide quotes for affordable car insurance. With SelectQuote, you can compare rates from several. The top picks for the best and cheapest car insurance in Georgia are Geico, USAA, and State Farm. Geico offers rates starting at $24 per month. The cheapest car insurance company in Georgia is Country Financial, which charges an average of $79 per month for state-minimum coverage. In addition to being. We help you compare, find and buy the right car insurance policy at the lowest possible price for you. Start your quote from anywhere online or over the phone. Car insurance in Georgia costs an annual average of $2, for full coverage and $ for minimum coverage. Find quotes for your area. COUNTRY Financial offers the cheapest minimum car insurance policy in Georgia and for most driver profiles. Other types of drivers, like teens. Whether you're a standard driver or a high-risk driver, we compare rates to find you cheap car insurance for the coverage you need to drive safely on Georgia. Car insurance in Georgia costs $ for a 6-month policy — 18% more expensive than than the national average rate. Compare the cheapest car insurance quotes in Atlanta from Hugo, Auto-Owners, State Farm, and more. Quotes updated August We work with several car insurance companies in Georgia to provide quotes for affordable car insurance. With SelectQuote, you can compare rates from several. The top picks for the best and cheapest car insurance in Georgia are Geico, USAA, and State Farm. Geico offers rates starting at $24 per month. The cheapest car insurance company in Georgia is Country Financial, which charges an average of $79 per month for state-minimum coverage. In addition to being. We help you compare, find and buy the right car insurance policy at the lowest possible price for you. Start your quote from anywhere online or over the phone. Car insurance in Georgia costs an annual average of $2, for full coverage and $ for minimum coverage. Find quotes for your area.

While it is necessary, finding cheap car insurance doesn't have to be frustrating or expensive. Budget Insurance Agency has over 25 years of experience finding. premiums, and updates on the latest trends in the industry. How Car Type Affects Rates. The Effect of Vehicle Type on Auto Insurance Rates in Atlanta, Georgia. For minimal liability coverage, the average cost of car insurance in Georgia is $ per year or $56 per month. In addition to the location, Georgia car. Brunswick Insurance Rates by Vehicle If you look at the first table above, the cheapest vehicles to insure in Brunswick are typically trucks and vans, at $ The average cost of minimum-coverage car insurance in Georgia is $73 per month or $ per year. For full coverage, the average is $ per month or $2, per. How much does an auto insurance policy cost in Georgia? According to Bankrate the average annual cost for minimum coverage in Georgia is $ For full. Full coverage insurance in Georgia costs $ per month, or $2, per year, on average. This is more expensive than the national average cost of full coverage. Data from ValuePenguin indicate that drivers pay the lowest rates for full coverage with Georgia Farm Bureau, with an average annual premium cost of $ The average cost of full coverage car insurance in Georgia is $1,, higher than the national average by $ Drivers will pay an average of $ per year for. Mercury provides cheap auto insurance without compromising on quality. Learn more about our cheap auto insurance policies in Georgia. Auto-Owners and State Farm are two of the best traditional car insurance companies in Georgia, based on their low average rates, J.D. Power customer. The top picks for the best and cheapest car insurance in Georgia are Geico, USAA, and State Farm. Geico offers rates starting at $24 per month. Call , request a quote online or visit Direct Auto location near you to get a Georgia car insurance quote from Direct Auto! We always offer. The average cost of full coverage car insurance in Georgia is $1,, higher than the national average by $ Drivers will pay an average of $ per year for. According to our data for , the cheapest car insurance company for full coverage in Atlanta is Georgia Farm Bureau at $ per month or $ per six-month. What Is the Average Premium for Cheap Full Coverage Car Insurance in GA? Georgia drivers pay an average of $ monthly for full coverage. Full coverage. Get cheap auto insurance in Georgia From Atlanta to Columbus and Augusta to Savannah, safe drivers in Georgia can get affordable car insurance with Root. Cheap Minimum Liability Car Insurance in Georgia · Travelers: $78 per month · Arrowhead: $85 per month · Amigo MGA: $71 per month · GEICO: $63 per month · The. The average car coverage cost in Georgia is $1, per year, which is lower than the national average cost. What Affects Car Insurance Rates in Georgia? Several.